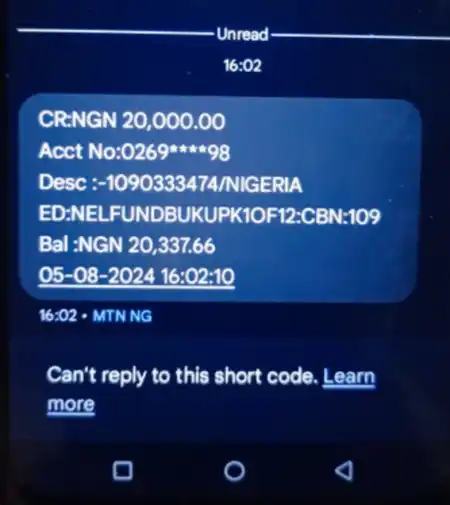

The Nigerian Education Loan Fund (NELFUND) is currently disbursing N20,000.00 monthly stipends for students from all tertiary institutions. The Director of NELFUND has made it known that students are invited to apply for this government loan with no interest fee.

NELFUND Student Loan 2024

The Nigerian government has assigned the student loan management to NELFUND. The Nigerian Education Loan Fund is the official federal government agency in charge of student loan in Nigeria, and the official website is nelf.gov.ng.

The Student’s Loan Act allows Nigerian students to access zero-interest loans for institutional charges and upkeep in any higher institution within Nigeria.

NELFUND loan disbursement is currently ongoing. Many students have been paid so far the sum of 20,000 naira per student. New higher institutions are also being added to the list to reach more students in Nigeria.

Applicants who are yet to receive their SMS notification of the payment should wait until their schools are in session. Also, make sure your application information, and submitted bank account details are correct. All eligible students will be paid.

But remember that this is a loan and NOT a grant, except that it has no interest attached. For those who are yet to apply, you HAVE to! This guide is everything you need concerning NELFUND application portal, eligibility requirements, and application process.

NELFUND Student Loan Eligibility Requirements 2024

All full-time students are eligible for the loan, but only applicants who have successfully applied will be paid.

Students who wish to apply for the loan must meet the following requirements:

- Students must have secured admission into any public Nigerian university, polytechnic, college of education, or vocational school

- Applicants must provide proof of admission, including their Name, Date of Birth, Admission Letter, JAMB number, Matriculation number, and BVN

- There is no age limit for applicants

- All new and existing students in the above institutions can apply for the loan

- Direct entry students into higher institutions can apply for the loan but must have a JAMB number

- Scanned admission letter for new students (compulsory), scanned Student Identification Card (optional)

Students from some institutions, whose institutional fees have already been paid by NELFUND, are already receiving their upkeep stipends for this month. All eligible students will receive their stipends every month.

How to Apply for NELFUND Student Loan 2024

Students who wish to apply for the loan can follow these steps:

- Go to https://nelf.gov.ng

- Click on APPLY NOW and complete the NELFUND application form or visit https://portal.nelf.gov.ng/ directly

- Enter your personal information on the NELFUND student loan online registration form, including the name of institution of study, admission or matric number, JAMB number, date of birth, NIN, and BVN

- Submit your application details to complete your account creation

That’s it. Applicants will receive a notification, and the status of the loan application can be viewed in the applicant’s profile on the portal.

NELFUND will disburse the loan within 30 days of approval of successful applications. No payment is required before the disbursement of the loan. The loan is zero-interest and open to new and existing full-time students in tertiary institutions.

What You Should Know About NELFUND Loan

- 10% of the beneficiary’s salary will be deducted at source by the employer

- Self-employed beneficiaries are required to remit 10% of their monthly profit to the Fund

- Beneficiaries can repay beyond the statutory 10% monthly repayment if they wish

NELFUND loan 2024-2025 academic session is open to all public tertiary institutions. The disbursement is going on in phases, and is open only to students studying or desiring to study in federal higher institutions in Nigeria. More phases will be announced in due course.

How Much NELFUND Loan Can Students Apply For?

The amount a student can apply for is determined by the institutional charge of each institution. The loan will cover the cost of institutional charges and upkeep if required by the student. Institutional charges will be remitted directly to the applicants’ institutions, and the upkeep will be paid to the applicant on a monthly installment basis.

Repayment Schedule

The loan is due for repayment two years after the completion of NYSC. Beneficiaries should notify NELFUND by a sworn court affidavit every three months after two years post-NYSC if they are still unable to gain employment. Repayment can start as soon as the beneficiary has the means to repay, even before gaining employment. Deliberate default could result in penalties, legal action, and potential damage to the credit score.

READ ALSO:

- NYIF Application Portal

- Tony Elumelu Foundation Grant

- NDDC Youth Internship Scheme

- Rich People’s Email Addresses

Students will apply for NELFUND loan every academic session via the application portal. Just log into your account and apply again. Remember, the official NELFUND application website is nelf.gov.ng. Any website other than this is a scam.

Leave a Reply